|

Breaking the Cycle of Poverty in Rural Honduras

| |

Other Ways to Give

Planned Giving

Planned Giving is a wonderful way for you to make a larger, lasting contribution to Lunches for Learning. It's also much easier than you might think. A planned gift is simply a gift that you have allocated to L4L in your estate plans - most common is a bequest in your Last Will and Testament or Living Trust.

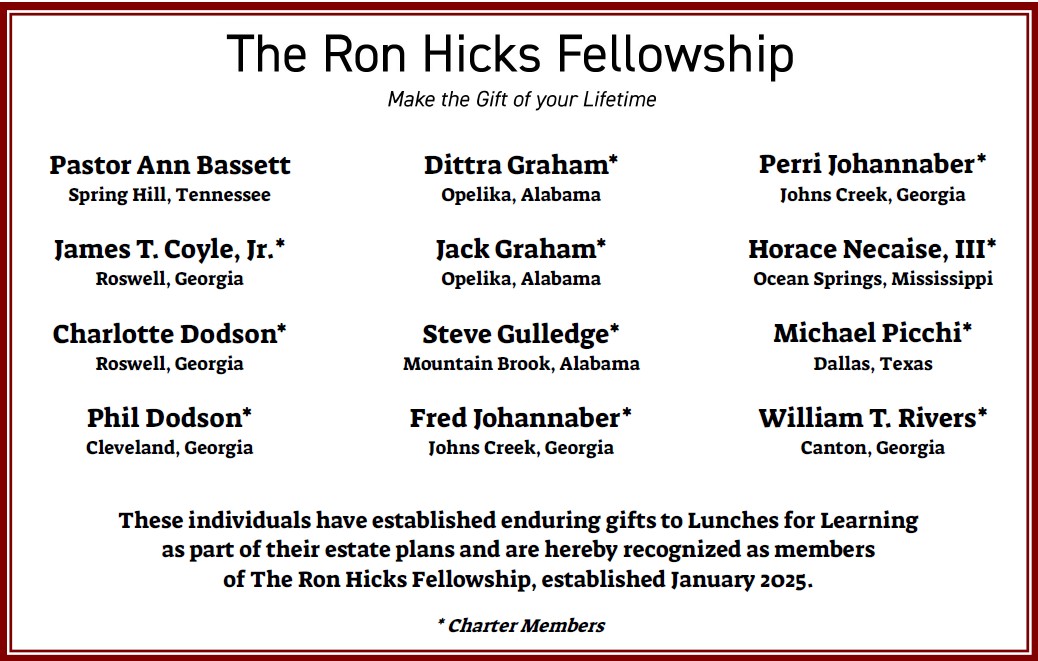

To recognize supporters who have established planned gifts to L4L, we have created The Ron Hicks Fellowship. By establishing your planned gift, you become qualified for induction into this society of supporters named in memory of our beloved Founder.

While annual giving supports L4L operations in the current year, planned gifts will be allocated to our Endowed Growth Fund which will allow your legacy gift to fund growth and expansion to reach greater numbers of starving children in Honduras for many years into the future.

If you are currently drafting your Will, here is an example of bequest language:

"I give, devise, and bequeath to Lunches for Learning, Inc., a non-profit corporation, ______ (insert a dollar amount or percentage of your estate) as an unrestricted gift."

If your Will is already established, follow this link or click on the image here to view a simple one-page codicil that than be completed as an addendum, meaning that you won't have to re-write your entire Will in order to add a bequest to Lunches for Learning.

Give Through Your RMD A Qualified Charitable Distribution (QCD) is a great way to reduce required minimum distributions (RMDs) and optimize the tax benefits of supporting Lunches for Learning.

A Qualified Charitable Distribution (QCD) is a great way to reduce required minimum distributions (RMDs) and optimize the tax benefits of supporting Lunches for Learning.

QCDs allow retired individuals who have reached the age of 73 to make tax-free donations directly from an IRA to Lunches for Learning, potentially satisfying all or part of their annual RMDs. Generally, you can make a QCD from any tax-deferred IRA account, such as a traditional IRA, inherited IRA, SIMPLE IRA, and SEP IRA.

A QCD allows you to support L4L in a meaningful way while also helping reduce the tax hit from your RMD.

Your financial planner can help you get the ball rolling, or we would also be glad to help point you in the right direction!

Employee Matching Gifts

Did you know that you could double or even triple your giving to Lunches for Learning if your employer has an Employee Matching Gifts program? Did you know that you could double or even triple your giving to Lunches for Learning if your employer has an Employee Matching Gifts program?

Many companies encourage their employees to participate in charitable giving by matching their gifts to qualified non-profit programs. Because L4L is an IRS-approved 501(c)(3) non-profit organization, we are qualified to receive these charitable gifts.

Simply contact your employer's HR department to inquire as to whether they have an Employee Matching Gift program, and you're off to the races. Most employers match giving at a 1:1 ratio, but some go even higher than that - to 2:1 or even 3:1. This means that a $500 from you could grow to $1,000 or more alongside your employer's matching gift.

Over the past few years, Lunches for Learning has received matching gifts through our donors who are employed by the following companies:

- Aon

- Chevron

- Cisco

- Coca-Cola

- Kohl Marketing

- UBS

- VMWare

If you have any questions about how employee matching gift programs work, please contact us to learn more.

|

|

|